U.S. power-generating companies are announcing plans for the highest volume of new natural gas-fired capacity. This is after years as the AI boom is driving electricity demand.

During the first half of 2024, electricity-generating firms unveiled plans for the new gas-powered capacity. According to data from the Sierra Club cited by Bloomberg, this is equal to all capacity announced in 2020.

The increase in gas-fired generation jeopardizes the current U.S. emissions and ‘clean grid’ goals.

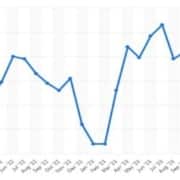

Natural gas-fired electricity generation in the United States has jumped year-to-date compared to last year. This is as total power demand rose with warmer temperatures and demand from data centers.

Natural gas could be a big winner in the AI-driven power demand surge in the U.S. Many tech companies prefer to power their AI development centers with solar and wind. The need to get these data centers built and powered fast would boost demand for natural gas.

After more than a decade of flatlining power consumption in America, the AI boom, chip, and other tech manufacturing are leading to higher U.S. electricity demand.

For years, natural gas has accounted for the largest share of U.S. power generation, at around 40% of all electricity-generating sources.

This year, natural gas is expected to provide around 42% of America’s electricity, similar to last year, as total consumption is set to grow by 3% in 2024 and another 2% in 2025, per data from the U.S. Energy Information Administration (EIA).

Click here to read the full article

Source: Oil Price

—

Do you have any questions or thoughts about the topic U.S Natural Gas Power? Feel free to contact us here or leave a comment below.