Crude oil prices climb higher today, after the release of production data from OPEC and Russia, showing both declined in December.

The recent employment survey released by the United States has unveiled a promising outlook for the economy, which has significant implications for the oil market. The data indicates that layoffs remain notably low, a trend that reflects not only a stable job market but also a growing confidence among employers. This stability is crucial, as it suggests that businesses are not only retaining their workforce but are also investing in their employees through retention strategies. Moreover, the survey highlights an increase in job openings, signaling that companies are expanding operations and seeking to hire additional talent. This surge in job availability is a strong indicator of economic vitality, as it reflects a demand for goods and services that often correlates with increased energy consumption.

The implications of these employment trends are particularly bullish for the oil market. As economic activity ramps up, the demand for oil typically rises in tandem, driven by the need for transportation fuels, industrial energy, and heating. Additionally, a robust job market generally translates to higher consumer confidence, which can lead to increased spending on travel and leisure activities, further boosting oil consumption. Investors are likely to view these positive employment figures as a harbinger of sustained economic growth, which could lead to a tighter oil supply-demand balance. As such, the synergy between a healthy labor market and the oil industry may serve to reinforce upward price pressures, making the current economic landscape particularly favorable for oil market stakeholders.

The Latest Market Update on Oil Prices Climb

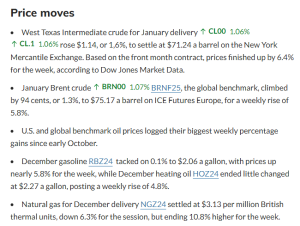

As of the latest market update, Brent crude oil is currently trading at $77.34 per barrel, reflecting a notable increase from its opening price earlier in the trading session. This upward movement in Brent crude prices can be attributed to a variety of factors, including geopolitical tensions, supply constraints, and fluctuations in global demand. Investors and analysts are closely monitoring these developments, as they have significant implications for both the energy market and the broader economy. The ongoing recovery from pandemic-related disruptions and shifts in consumption patterns are also contributing to the volatility observed in oil prices.

In parallel, West Texas Intermediate (WTI) crude oil is tradeable at $74.65 per barrel, also showing an increase from its opening value. The rise in WTI prices is indicative of the overall bullish sentiment in the oil market, driven by expectations of recovering demand as economies continue to emerge from pandemic restrictions. Furthermore, factors such as inventory levels, production cuts by OPEC+, and seasonal variations in consumption can heavily influence WTI pricing. Market participants are to remain vigilant as these variables evolve, as they will play a crucial role in shaping future oil price trajectories and influencing strategic decisions for businesses across various sectors.

Click here to read the full article

Source: Oil Price

—

Do you have any questions or thoughts about the topic of oil prices climb? Feel free to contact us here or leave a comment below.