DISCLAIMER: We are not financial advisors. The content on this website is for educational purposes only and merely cites our own personal opinions. In order to make the best financial decision that suits your own needs, you must conduct your own research and seek the advice of a licensed financial advisor if necessary. Know that all investments involve some form of risk and there is no guarantee that you will be successful in making, saving, or investing money; nor is there any guarantee that you won’t experience any loss when investing. Always remember to make smart decisions and do your own research!

Overriding royalty interests (ORRI) are a unique and valuable aspect of the oil and gas industry, particularly in a state like Texas, which has a rich history of energy production. If you’re a landowner, investor, or industry professional involved in the Texas oil and gas sector, understanding overriding royalty interests is essential. In this comprehensive guide, we will explore the world of overriding royalty interests in Texas, shedding light on what they are, how they work, their advantages and disadvantages, and the key considerations for landowners and investors.

Texas has long been synonymous with the oil and gas industry, making it a prime location for investment and ownership in this sector. Overriding royalty interests are a critical aspect of this industry, allowing landowners and investors to participate in the energy wealth of the state. In this guide, we’ll take a deep dive into overriding royalty interests in Texas, exploring their nuances, benefits, risks, and what you need to know to navigate this complex terrain.

Understanding Overriding Royalty Interests

An overriding royalty interest (ORRI) is a share of the revenue that produce from the extraction and production of minerals, such as oil and natural gas, from a specific piece of land. ORRIs are created by a royalty interest that is “overriding” the rights of the working interest owner. In simpler terms, the holder of an ORRI is entitled to a portion of the income generated from the minerals extracted from a property, regardless of whether they own the property itself.

An ORRI is typically expressed as a percentage, such as 1% or 3%, and it is calculated based on the gross proceeds from the sale of extracted minerals. This interest is often granted to someone other than the property owner, such as a geologist, drilling company, or a professional in the industry.

The Mechanics of Overriding Royalty Interests

To understand how overriding royalty interests work, consider the following scenario:

- A landowner, say in Texas, leases their land to an oil and gas company for drilling and extraction.

- The lease agreement specifies the terms, including royalty rates, which are typically shared between the landowner (the lessor) and the company (the lessee).

- Let’s say the landowner and the company agree on a 20% royalty rate, meaning the landowner receives 20% of the revenue from the minerals extracted from their land.

- Now, suppose a geologist or investor holds an overriding royalty interest of 3% on this property. This ORRI entitles them to 3% of the gross revenue from mineral sales, in addition to the landowner’s 20% royalty.

- The remaining 77% of the revenue goes to the drilling company as the working interest.

In this way, the holder of the overriding royalty interest benefits from the minerals extracted from the land without being responsible for the operational costs or day-to-day activities involved in drilling and production.

Advantages of Overriding Royalty Interests

Overriding royalty interests offer several advantages for landowners and investors in the Texas oil and gas industry:

Passive Income Stream

Holders of ORRIs receive a steady and often passive income stream. They can enjoy financial benefits without actively participating in the operations, making ORRIs an attractive source of income for many.

Minimal Operational Responsibilities

ORRI owners are not responsible for the operational activities, expenses, or risks associated with drilling and production. This minimizes their operational involvement and risk exposure.

Potential for Profit

Texas has a long history of successful oil and gas production, making it a prime location for ORRI ownership. With the potential for significant profits, investors are under pressure to the state’s energy sector.

Challenges and Risks of Overriding Royalty Interest

While ORRIs offer numerous advantages, they are not without their challenges and risks:

Market Volatility

The oil and gas industry is known for its price volatility. Fluctuations in energy prices can impact the profitability of ORRIs and the income generated for owners.

Lease Terms and Royalty Rates

The terms of the lease agreement and the royalty rates negotiated between the landowner and the drilling company can impact the financial benefits of an ORRI. Unfavorable terms may reduce the potential income.

Environmental and Regulatory Concerns

Oil and gas operations are subject to complex and evolving regulatory frameworks at federal, state, and local levels. Staying compliant with these regulations and addressing environmental concerns is a challenge for ORRI owners.

Key Considerations for Landowners and Investors

For landowners and investors interested in overriding royalty interests in Texas, several key considerations should remain in mind:

Lease Negotiations

Landowners should carefully review and negotiate lease agreements to ensure favorable terms, royalty rates, and protection of their interests. Legal and industry expertise can be invaluable in this process.

Legal and Tax Implications

The legal and tax aspects of ORRI ownership can be complex. Seek professional guidance to understand the unique implications and potential tax benefits associated with ORRIs.

Due Diligence

Before investing in ORRIs, conduct thorough due diligence. Evaluate the potential for profitability, the stability of the drilling company. And the environmental and regulatory factors that may impact the investment.

Overriding Royalty Interests vs. Working Interests

It’s essential to distinguish between overriding royalty interests (ORRIs) and working interests (WIs). While ORRI owners receive a share of the revenue without operational responsibilities, WI owners are actively involved in the drilling and production operations. WI owners also bear a share of the operational costs and risks. Understanding the differences between these interests is critical when considering involvement in the oil and gas industry.

Overriding royalty interests in Texas offer a opportunity for landowners and investors to participate in the state’s oil and gas industry. While they provide a steady income stream and the potential for substantial profits, they are not without their challenges and risks. By carefully considering lease terms, understanding legal and tax implications, and conducting thorough due diligence, landowners and investors can make informed decisions regarding ORRIs in Texas. As a dynamic and ever-evolving industry, the Texas oil and gas sector continues to be a promising source of income and investment opportunities through overriding royalty interests.

If you have further questions related to the Overriding Royalty Interest topic, feel free to reach out to us here.

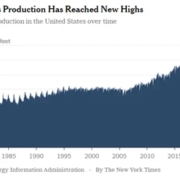

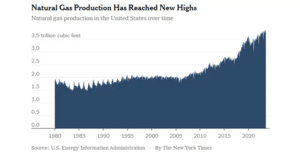

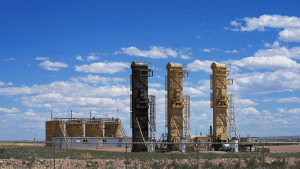

The Permian Basin produced nearly 6 million barrels of oil a day in 2023. That’s more than Iraq, the United Arab Emirates or Kuwait, according to Peter McNally, analyst at Third Bridge.

The Permian Basin produced nearly 6 million barrels of oil a day in 2023. That’s more than Iraq, the United Arab Emirates or Kuwait, according to Peter McNally, analyst at Third Bridge.