Ovintiv Inc., one of the leading oil driller companies in the shale drilling sector, has recently updated its production forecast for 2024, marking itself as the second oil and gas company to make such an adjustment this year. The firm now projects a production range of between 570,000 and 580,000 barrels of crude oil per day, a notable increase from its previous estimate, which ranged from 545,000 to 575,000 barrels. This revision, calculated from the midpoint of the newly established range, indicates a 2.7% increase in anticipated production levels. Furthermore, Ovintiv has also raised its target for the oil and condensate segment, adjusting it upward by approximately 1%, with a goal of reaching around 208,000 barrels per day. This strategic adjustment reflects the company’s confidence in its operational capabilities and the overall market conditions.

Ovintiv’s decision to enhance its production outlook follows a similar move by Matador Resources Co., highlighting a trend among U.S. drillers who are cautiously navigating the current energy landscape. While many companies are focusing on maintaining stable or modest growth in output, this shift in forecast underscores Ovintiv’s strategic emphasis on maximizing production efficiency while balancing capital allocation to shareholders. As the industry gradually transitions towards a more disciplined approach to growth, Ovintiv’s proactive stance may position it favorably for future opportunities, enabling the company to strengthen its drilling assets and enhance shareholder returns in a competitive market environment.

Oil Driller Performance

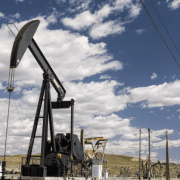

The performance of oil wells in the prominent Permian Basin, which extends across Texas and New Mexico, has consistently surpassed industry expectations, presenting a complex challenge for the Organization of the Petroleum Exporting Countries (OPEC) and its allies. These countries have been actively engaged in a strategic effort to gradually unwind coordinated production restrictions that were initially implemented to support and stabilize crude oil prices in response to volatile market conditions. However, the unexpected surge in output from the Permian Basin may complicate these efforts, as increased production can lead to an oversupply in the market, potentially undermining the pricing strategies that OPEC and its allied nations have meticulously crafted. This development raises questions about the sustainability of current pricing levels and may prompt OPEC to reconsider its production policies in light of the new dynamics introduced by the Permian’s robust performance.

Production Comprises Oil and Condensate

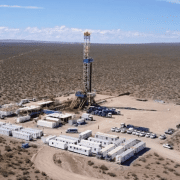

In the context of this evolving market landscape, Ovintiv, a prominent player in the region, has strategically positioned its production portfolio to capitalize on the diverse hydrocarbon resources available in the Permian Basin. Currently, approximately one-third of Ovintiv’s production comprises oil and condensate, while the remaining two-thirds consists of natural gas and natural gas liquids. This balanced approach not only allows the company to mitigate risks associated with fluctuations in oil prices but also aligns with the growing demand for natural gas as a cleaner energy alternative. By maintaining a diversified portfolio, Ovintiv is well-positioned to navigate the complexities of the current market environment, adapting to changes in consumer preferences and regulatory landscapes while contributing to the ongoing discourse around energy production and sustainability in the context of the larger global energy transition.

Click here to read the full article

Source: World Oil

—

If you have any questions or thoughts about the topic, feel free to contact us here or leave a comment below.