⚠️ IMPORTANT LEGAL DISCLAIMER:

The information provided on this page related to Carbon Capture and Storage is for general informational purposes only. and does not constitute legal, financial, or investment advice. Oil and gas laws, mineral rights regulations, and royalty structures vary significantly by state and jurisdiction. While we strive to provide accurate and up-to-date information, no guarantee is made to that effect, and laws may have changed since publication.

You should consult with a licensed attorney specializing in oil and gas law in your jurisdiction, a qualified financial advisor, or other appropriate professionals before making any decisions based on this material. Neither the author nor the publisher assumes any liability for actions taken in reliance upon the information contained herein.

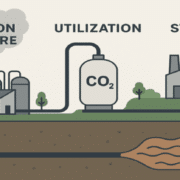

Carbon capture and storage, often abbreviated as CCUS, is emerging as one of the most important technologies in the global effort to combat climate change. The process involves capturing carbon dioxide emissions from industrial facilities, power plants, and other sources before they enter the atmosphere. The captured emissions are then transported and either stored underground in geological formations or utilized for industrial purposes.

Beyond its environmental benefits, CCUS presents significant revenue opportunities. Governments, private investors, and corporations are increasingly looking at this technology not just as a compliance tool but also as a pathway to create value. From enhanced oil recovery and industrial applications to carbon trading and green financing, the potential economic gains are substantial.

This article explores the many ways CCUS can become a profitable venture, the markets it touches, the business models available, and the challenges that must be overcome to realize these opportunities.

The Economic Rationale for CCUS

CCUS is not just about reducing greenhouse gas emissions. It is about creating an economic framework where carbon management generates income streams. The world is moving toward net-zero goals, and with stricter environmental regulations, industries face mounting pressure to decarbonize.

For many sectors such as cement, steel, and petrochemicals, eliminating emissions entirely is nearly impossible with current technologies. CCUS offers these industries a way to continue operating while meeting climate targets. The willingness of governments and consumers to pay for carbon reduction creates fertile ground for revenue generation.

Moreover, investors are beginning to demand stronger environmental performance from corporations. By adopting CCUS, companies not only comply with regulations but also gain access to capital from sustainability-driven funds, bonds, and other green financing instruments.

Revenue from Carbon Utilization

One of the most promising areas of CCUS revenue opportunities lies in carbon utilization. Instead of treating captured carbon dioxide as waste, industries can turn it into a valuable resource.

Enhanced oil recovery

In enhanced oil recovery, carbon dioxide is injected into mature oil fields to boost extraction. This process has been used for decades, but coupling it with captured emissions creates a sustainable cycle. Oil producers benefit from higher yields while positioning themselves as contributors to carbon management.

Industrial products

Carbon dioxide can be used to manufacture building materials such as concrete and aggregates. By mineralizing carbon dioxide into construction products, companies not only reduce emissions but also create durable materials that lock carbon away permanently.

Fuels and chemicals

Through advanced technologies, captured carbon can be transformed into synthetic fuels, plastics, and chemicals. This opens new markets for carbon-derived products that can replace fossil-based alternatives, aligning with circular economy goals.

Agriculture and food industries

Some sectors are experimenting with using carbon dioxide in greenhouses to stimulate plant growth. Additionally, food and beverage companies can use captured carbon for carbonation in drinks, creating a direct commercial use.

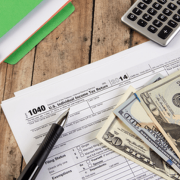

Government Incentives and Tax Benefits

Policy frameworks play a critical role in making CCUS projects economically viable. Many governments around the world are providing direct subsidies, tax credits, and other financial incentives to encourage adoption.

Tax credits for carbon capture allow companies to offset their operational costs by deducting captured and stored carbon dioxide from their taxable income. In some regions, the more carbon captured and stored, the greater the credit received.

Subsidies and grants are also offered for research and infrastructure development. These programs reduce the financial burden of setting up capture facilities, pipelines, and storage sites.

Carbon pricing systems, such as cap-and-trade programs, create additional incentives. Companies that capture and store carbon can generate carbon credits, which can be sold to other entities that need to meet emissions targets. This transforms carbon capture into a market-driven opportunity.

Opportunities in Carbon Trading Markets

Carbon markets represent a major revenue stream for CCUS projects. As nations tighten their climate commitments, the demand for carbon credits is increasing.

Voluntary carbon markets allow corporations and individuals to purchase credits to offset their emissions. High-quality CCUS projects generate credits that are often more attractive to buyers because of their measurable, verifiable, and permanent impact.

Compliance markets, regulated by governments, require industries to meet emission caps. Here, CCUS projects can sell credits directly to companies in need of compliance tools.

By participating in these markets, project developers not only recover their investments but also create long-term income. Carbon credits associated with CCUS often command premium pricing due to their strong environmental credibility.

The Role of Energy Companies

Energy companies are central to the future of CCUS. They possess the technical expertise, infrastructure, and financial resources necessary to scale projects. For them, CCUS is both a compliance requirement and a profit opportunity.

Oil and gas companies are investing heavily in CCUS to decarbonize their operations and extend the life of their assets. By integrating carbon capture into refineries, petrochemical plants, and power stations, they reduce emissions while maintaining competitiveness.

Additionally, by selling carbon management services to other industries, energy companies can diversify their revenue streams. For instance, an oil major could capture carbon dioxide from a steel mill, store it in depleted reservoirs, and generate credits for both parties.

Opportunities for Industrial Sectors

Heavy industries such as cement, steel, and chemicals are among the hardest to decarbonize. These industries face increasing scrutiny from regulators and investors. CCUS provides them with a pathway to reduce emissions while maintaining production.

By adopting CCUS, industrial firms can access green financing, win contracts with sustainability-conscious customers, and improve their brand reputation. Some companies are already marketing low-carbon steel or concrete, commanding premium pricing in global markets.

Partnerships between heavy industries and CCUS developers also create new business models. Shared infrastructure projects, where multiple factories send captured carbon to a centralized storage hub, reduce costs and spread risks.

Financing and Investment Opportunities

The financial sector is increasingly interested in CCUS due to the global push toward sustainable investments. Institutional investors, venture capital firms, and development banks are providing capital for projects with strong environmental benefits.

Green bonds and sustainability-linked loans are powerful financing tools for CCUS. Companies that demonstrate measurable carbon reduction through capture and storage can secure favorable interest rates and broader access to capital markets.

Private equity and venture capital are also funding startups developing innovative capture and utilization technologies. These investors see long-term profitability as governments and corporations commit to net-zero targets.

Infrastructure Development as a Revenue Stream

Building and operating CCUS infrastructure represents another avenue for income. Pipelines, compression facilities, and storage reservoirs require specialized expertise and long-term management.

Companies that invest in this infrastructure can generate steady revenues by charging fees for transporting and storing carbon dioxide. Just as natural gas pipeline operators earn income by moving gas, carbon pipeline operators will profit from moving emissions.

Storage hubs, often located in saline aquifers or depleted oil fields, can serve multiple industrial clients. This shared model reduces costs for participants while creating a reliable business model for infrastructure owners.

Technological Innovation Driving Profitability

Advances in capture, transportation, and storage technologies are making CCUS more efficient and cost-effective. Innovation directly translates into improved revenue potential.

Membrane technologies, chemical solvents, and cryogenic processes are reducing the cost of capture. Artificial intelligence and digital monitoring tools improve efficiency and safety in storage operations.

Companies that lead in technology development can generate revenue not only from deploying CCUS internally but also by licensing their technologies to other firms. Intellectual property and patents in this space will become valuable assets.

Environmental and Social Value as Revenue

Beyond direct financial income, CCUS projects generate social and environmental value. This value can be monetized through corporate reputation, brand positioning, and stakeholder engagement.

Companies that invest in CCUS gain credibility with regulators, communities, and investors. This credibility can translate into market share, favorable policy treatment, and stronger customer loyalty.

For communities, CCUS projects create jobs, infrastructure, and local investment. Governments are more likely to support companies that contribute to both environmental protection and economic development.

International Opportunities for CCUS

Global collaboration is essential for scaling CCUS. Different regions present unique opportunities.

In North America, generous tax incentives and a strong oil and gas industry create fertile ground for projects. At Europe, strict climate policies and carbon pricing mechanisms encourage adoption. In Asia, growing industrial output provides both a challenge and an opportunity for large-scale deployment.

International carbon markets also allow cross-border trade in credits, enabling countries with advanced CCUS projects to sell offsets to those struggling to reduce emissions domestically.

Challenges in Unlocking Revenue Opportunities

While the potential for revenue is significant, challenges remain. High upfront costs, regulatory uncertainty, and public skepticism about storage safety can slow adoption.

Ensuring that storage is permanent and verifiable requires rigorous monitoring and reporting, which adds to expenses. Investors may be hesitant until projects demonstrate consistent profitability.

Nevertheless, as technology matures and regulations stabilize, these barriers are likely to diminish. The global urgency of climate change ensures continued demand for carbon reduction solutions.

Future Outlook for CCUS as a Revenue Generator

The future of CCUS is closely tied to the global energy transition. As industries and governments aim for net-zero goals, the demand for large-scale carbon management will rise.

New markets for carbon-derived products, growing carbon trading systems, and increased availability of green financing will enhance revenue opportunities.

Ultimately, CCUS will evolve from being viewed as a compliance cost to a profit-generating solution. Companies that embrace this shift early will secure competitive advantages and long-term value creation.

Carbon capture and storage is more than an environmental tool; it is a powerful economic opportunity. Through utilization, carbon markets, government incentives, infrastructure development, and technological innovation, CCUS can generate multiple revenue streams.

Industries that adopt CCUS not only reduce their environmental footprint but also unlock financial gains. Investors, policymakers, and corporations all stand to benefit from this emerging sector.

As the global economy moves toward sustainability, CCUS represents one of the most promising pathways to align environmental responsibility with profitability.