DISCLAIMER: We are not financial advisors. The content on this website related to Environmental Stewardship is for educational purposes only. We merely cite our own personal opinions. Do you want to make the best financial decision that suits your own needs? You must conduct your own research and seek the advice of a licensed financial advisor if necessary. Know that all investments involve some form of risk. There is no guarantee that you will be successful in making, saving, or investing money. Nor is there any guarantee that you won’t experience any loss when investing. Always remember to make smart decisions and do your own research!

Managing mineral rights responsibly is crucial in today’s world. Especially as the global focus on sustainability, climate change, and environmental protection continues to intensify. As landowners, mining companies, and governments all play pivotal roles in extracting minerals from the earth, understanding how to incorporate environmental stewardship into the management of mineral rights is key to reducing ecological impact. This comprehensive guide delves into the principles, practices, and strategies for effective environmental stewardship when managing mineral rights.

The Intersection of Mineral Rights and Environmental Stewardship

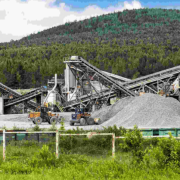

Environmental stewardship in mineral rights management involves balancing the extraction of natural resources with the protection and conservation of ecosystems. It is not simply about compliance with laws and regulations; it is about adopting proactive measures that ensure the health of the land, air, water, and wildlife during and after mineral extraction activities.

Mineral rights refer to the legal ownership of underground resources, such as oil, gas, and minerals. This ownership gives the right to extract these resources, but it also carries a responsibility to manage the extraction process in a way that minimizes damage to the environment. Effective stewardship ensures that the land can be reclaimed, habitats preserved, and local communities safeguarded against negative environmental consequences.

Understanding the Importance of Environmental Stewardship

The importance of environmental stewardship in mineral rights management goes beyond corporate responsibility; it has far-reaching consequences for ecosystems, human health, and local economies. Here are some key reasons why this issue is so critical:

- Protecting Biodiversity: Mineral extraction can destroy habitats, affect wildlife populations, and disrupt ecosystems. By managing mineral rights with an eye toward environmental stewardship, companies can minimize biodiversity loss and ensure that endangered species are protected.

- Water Conservation: Mining operations can significantly impact water resources. Ensuring that water is properly managed and conserved is a vital aspect of sustainable mineral extraction. Techniques like water recycling and proper wastewater treatment can help reduce pollution and safeguard water supplies for local communities and wildlife.

- Preventing Soil Degradation: Extraction activities often lead to soil erosion, compaction, and contamination. Good stewardship practices help prevent these issues by implementing erosion control measures, revegetation projects, and soil preservation techniques.

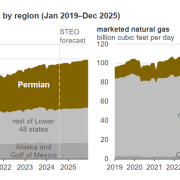

- Reducing Greenhouse Gas Emissions: Many mineral extraction processes release harmful gases, contributing to global warming. Through technological innovation and sustainable mining methods, greenhouse gas emissions can be reduced or offset.

- Ensuring Public Health and Safety: Environmental degradation from poorly managed mineral extraction can have long-term health consequences for local communities. Pollution, contaminated water supplies, and the disruption of local agriculture can harm residents’ well-being. Environmental stewardship practices help prevent these risks.

Legal and Regulatory Frameworks for Mineral Rights Management

In most countries, managing mineral rights is subject to a complex web of regulations and laws. These frameworks govern how mineral extraction is permitted, the environmental standards that must be adhered to, and the measures that need to be implemented for reclamation and post-extraction restoration.

While regulations vary by jurisdiction, many regions have national and local laws that mandate environmental assessments before mineral extraction can begin. These assessments look at the potential environmental impact of proposed projects and help guide decision-making regarding whether the project should proceed or how it should be modified to minimize harm.

Some key regulatory considerations include:

- Environmental Impact Assessments (EIAs): In many places, companies are required to conduct an EIA before obtaining permits to extract minerals. This comprehensive review assesses the potential effects of a project on local ecosystems, wildlife, water resources, and communities.

- Water Management Regulations: Mining operations must follow laws regarding water use and pollution prevention. Proper management of runoff, wastewater, and water bodies is essential to minimize the negative impact on aquatic environments.

- Air Quality Standards: Mineral extraction can contribute to air pollution, so managing dust, fumes, and emissions is necessary. Regulatory bodies often set air quality standards that mining operations must meet.

- Reclamation and Restoration Requirements: Once mining operations are completed, the land must be rehabilitated. Many regulatory frameworks mandate that companies return the land to its natural or functional state through replanting, soil restoration, and other reclamation efforts.

The Role of Technology in Sustainable Mineral Extraction

Technological advancements have played a major role in making mineral extraction more environmentally friendly. Innovations in mining practices, resource recovery, and environmental monitoring are helping companies reduce their ecological footprint.

- Reduced Impact Mining Techniques: In the past, mineral extraction often involved extensive and destructive practices. Today, mining companies use more precise methods, such as underground mining or directional drilling, which limit surface disturbance and reduce environmental impact.

- Recycling and Reusing Waste: Rather than discarding waste materials, modern mining technologies focus on recycling and reusing byproducts from extraction. This can include recovering metals from tailings, using waste heat for energy production, and repurposing waste materials for construction or other industrial applications.

- Advanced Water Treatment: Technologies such as reverse osmosis and biofiltration allow mining companies to treat wastewater more effectively, making it safe for reuse or discharge into the environment. This is crucial for preventing contamination of nearby water bodies.

- Remote Sensing and Monitoring: Remote sensing technologies, such as drones, satellite imagery, and sensors, allow for real-time monitoring of environmental conditions at mining sites. This helps identify and address potential environmental issues before they become severe.

- Carbon Capture and Storage: The extraction and processing of fossil fuels often generate significant carbon emissions. Carbon capture and storage (CCS) technologies can help reduce these emissions by capturing CO2 before it enters the atmosphere and storing it underground.

Best Practices for Environmental Stewardship in Mineral Rights Management

Effective environmental stewardship is rooted in best practices that aim to minimize harm while maximizing resource recovery. These practices should be integrated into all stages of mineral rights management, from exploration through to post-extraction.

Site Selection and Exploration

The first step in responsible mineral rights management is choosing an appropriate site for extraction. Environmental considerations during the exploration phase can significantly reduce the impact of future mining operations.

- Conduct Environmental Impact Studies Early: Before exploring or extracting resources, comprehensive environmental impact studies should be conducted to understand the potential effects on ecosystems, water resources, and local communities.

- Minimize Disturbance: When conducting exploration activities, companies should limit their footprint by minimizing the area disturbed by drilling, surveying, or road-building. Using low-impact techniques such as hand-held tools or helicopter-based surveying can reduce the environmental impact.

- Engage with Local Communities: Consultation with local communities and stakeholders should be part of the decision-making process. Indigenous peoples, local residents, and environmental advocacy groups can provide valuable insights into potential environmental risks and community concerns.

Responsible Extraction and Processing

During the extraction and processing stages, companies must ensure that they minimize environmental harm and comply with legal standards.

- Implement Water Management Strategies: Use technologies and best practices to manage water usage efficiently, reduce water contamination, and treat water for reuse. Constructing proper containment ponds and ensuring that wastewater is treated before being released into the environment is essential for preventing water pollution.

- Control Dust and Emissions: Dust and particulate emissions are significant concerns in mining operations. Dust suppression techniques, such as spraying water or using dust barriers, can help mitigate these effects. Mining facilities should also employ technologies that capture and treat air emissions to improve air quality.

- Use Eco-Friendly Equipment: Investing in equipment that reduces fuel consumption, lowers emissions, and minimizes noise pollution can significantly reduce the environmental impact of mining operations. Hybrid or electric-powered machinery is a growing trend in sustainable mining practices.

Post-Extraction: Reclamation and Restoration

Once mining activities conclude, the focus shifts to reclamation and restoration efforts. Effective stewardship includes plans for the restoration of ecosystems to their natural state or to a state that allows for other uses, such as agriculture or recreation.

- Plan for Land Reclamation from the Start: Land reclamation should be part of the planning process from the outset of the project. Reclamation efforts can include reshaping the land, replanting vegetation, and restoring soil quality.

- Monitor and Maintain Ecosystem Health: Post-extraction sites should be monitored for years to ensure that the ecosystem has fully recovered. This can include monitoring soil health, water quality, and biodiversity levels, and taking corrective action if necessary.

- Incorporate Community Engagement in Reclamation: Local communities should be involved in reclamation efforts, particularly when the land is to be repurposed for agriculture, recreation, or other community uses. Engaging with local stakeholders ensures that the restoration efforts meet the needs and desires of the people who will be affected by them.

The Role of Landowners in Environmental Stewardship

Landowners who hold mineral rights play an important role in ensuring that extraction activities are carried out responsibly. As the legal owners of the land’s resources, landowners have the ability to set expectations for environmental stewardship. This include their agreements with mining companies.

- Negotiate Responsible Contracts: Landowners can work with legal experts to ensure that contracts with mining companies include provisions for environmental protection. These can include clauses for waste management, land restoration, and compliance with all environmental regulations.

- Monitor Operations: Landowners can periodically monitor mining operations to ensure compliance with environmental standards and that the terms of the agreement are being upheld. They can also hold companies accountable for environmental damages that occur during extraction.

- Promote Sustainability: Landowners can encourage mining companies to adopt sustainable practices by prioritizing environmental criteria. It is when selecting contractors or by offering incentives for companies that implement green technologies.

Environmental stewardship in mineral rights management is not merely a regulatory requirement but a moral imperative. Start integrating sustainable practices throughout the exploration, extraction, and reclamation phases. With that, stakeholders can ensure that mineral extraction activities have minimal impact on the environment. Imagine government regulations to technological innovations and responsible landowner involvement. There will be numerous avenues for promoting sustainable resource management.

As the demand for natural resources continues to rise, adopting these principles of environmental stewardship will become increasingly important. Mitigate the negative effects of mining. Preserve ecosystems and ensure that future generations can enjoy our planet’s natural beauty and resources. Responsible management of mineral rights is an ongoing commitment that requires collaboration, innovation, and a dedication to the planet’s well-being.

Do you have further questions related to Environmental Stewardship? Feel free to contact us here.