Oil Jumps 8% on Stimulus Hopes, Spending Cuts by U.S. Producers

NEW YORK (Reuters) – Oil jumps over 8% on Tuesday, bouncing from the biggest rout in nearly 30 years a day earlier

On Monday, U.S. President Donald Trump pledged “major” steps to gird the U.S. economy against the impact of the spreading coronavirus outbreak.

Japan’s government said it planned to spend more than $4 billion in a second package of steps to cope with the virus.

U.S. shale producers, including Occidental Petroleum Corp OXY.N, deepened spending cuts that could reduce production.

“There was almost an immediate response from U.S. producers to cut spending that will likely result in diminished U.S. oil output in the months ahead,” said John Kilduff, partner at Again Capital LLC in New York, noting “The rapidity of that response helped buoy the market after Monday’s collapse.”

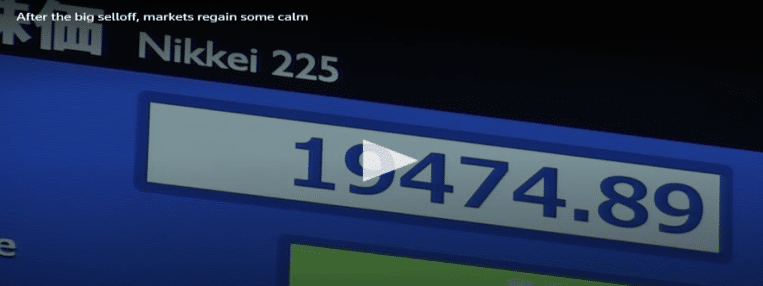

Oil plunged about 25% on Monday. It rebounded on Tuesday along with equities and other financial markets.

Brent futures LCOc1 rose $2.86, or 8.3%, to settle at $37.22 a barrel. U.S. West Texas Intermediate (WTI) crude CLc1 rose $3.23, or 10.4%, to settle at $34.36.

“The oil price went up today because it went insanely down yesterday, and some bargain hunters are driving things up,” said Bjoernar Tonhaugen, head of oil markets at energy consultant Rystad, noting “It will go down further with some days going up in between.”

Read the full article here

Source: Reuters

If you have further questions regarding oil jumps trends, feel free to reach out to us here.

Leave a Reply

Want to join the discussion?Feel free to contribute!