How to calculate oil and gas royalty payments

When it comes to oil and gas production, royalty payments are a significant aspect of the industry. For landowners who have leased their mineral rights to energy companies or investors who hold overriding royalty interests (ORIs), understanding how these royalty payments are calculated is crucial. In this comprehensive guide, we’ll delve into the world of oil and gas royalty payments, exploring the methods used to calculate them, factors affecting their determination, and key considerations for both landowners and investors.

What Are Oil and Gas Royalty Payments?

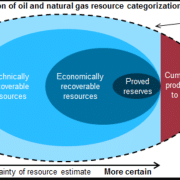

Oil and gas royalty payments are a share of the revenue generated from the extraction and production of oil and natural gas. These payments are made to the mineral rights owner or a party holding overriding royalty interests (ORIs). They serve as compensation for allowing energy companies to explore, drill, and extract oil and gas from the land.

Royalty payments are typically expressed as a percentage of the gross production or revenue from the sale of oil and gas. The specific percentage is determined in the lease agreement or contract between the mineral rights owner or ORI holder and the energy company. Common royalty rates can range from 12.5% to 25%, but they may vary depending on the negotiation between the parties involved.

Methods for Calculating Royalty Payments

The calculation of oil and gas royalty payments can be utilize in various ways, depending on the terms outlined in the lease agreement and the nature of the production. Here are some of the primary methods used:

Revenue-Based Calculation:

The most common method for calculating royalty payments is based on the revenue generated from the sale of oil and gas. This method involves applying the agreed-upon royalty rate to the gross revenue earned by the energy company. The formula is simple:

Royalty Payment = (Royalty Rate) x (Gross Revenue)

For example, if a landowner has a 20% royalty rate and the gross revenue from oil and gas sales is $100,000, the royalty payment would be $20,000.

Price-Based Calculation:

In some cases, royalty payments may be tied to the price of oil and gas in the market. This method can be more complex, as it involves tracking and verifying market prices. The formula might look like this:

Royalty Payment = (Royalty Rate) x (Volume Produced) x (Price of Oil or Gas)

The key challenge here is ensuring accurate price data and reporting.

Net Back or Net Revenue Calculation:

Instead of using gross revenue, the net back method deducts specific costs from the revenue before applying the royalty rate. This approach ensures that royalties are calculated after expenses related to transportation, processing, and other deductions. The formula can be convey as:

Royalty Payment = (Royalty Rate) x (Net Revenue)

Net revenue is the gross revenue minus allowable deductions.

4. Production Volumes-Based Calculation:

In some cases, royalty payments may be calculated based on the volume of oil and gas produced rather than revenue. This approach can be beneficial when there are significant variations in market prices. The formula might appear as:

Royalty Payment = (Royalty Rate) x (Volume Produced)

The key consideration is determining how production volume is measured and reported accurately.

The specific method used for calculating royalty payments should be clearly outlined in the lease agreement or contract between the parties. It’s important for landowners and ORI holders to understand which method is being applied to their situation to ensure accurate and fair compensation.

Factors Affecting Royalty Payments

Several factors can influence the amount of royalty payments received by landowners and ORI holders. Understanding these factors is essential for estimating and managing royalty income:

Production Volume:

The volume of oil and gas produced is a critical factor in royalty payments. It directly affects the revenue generated and, if production increases, so does the royalty payment.

Market Prices:

Market prices for oil and gas are highly volatile and can impact royalty payments significantly. Changes in market prices can result in fluctuations in revenue, affecting the royalties.

Deductions and Expenses:

Allowable deductions and expenses, such as transportation and processing costs, can reduce the gross revenue, affecting the net royalty payment.

Lease Terms:

The terms and conditions outlined in the lease agreement or contract are paramount. They define the royalty rate, calculation method, and any specific provisions that could influence the payment.

Lease Bonuses:

Some lease agreements include bonus payments to landowners or ORI holders upon signing the contract. These are typically separate from royalty payments and represent an upfront lump sum.

Regulatory and Taxation Factors:

Royalty payments may also be take hold of by government regulations, tax laws, and local ordinances, which can vary by region.

Key Considerations for Landowners

If you’re a landowner considering leasing your mineral rights for oil and gas exploration, there are essential considerations to keep in mind:

Negotiation is Key:

When entering into a lease agreement, negotiation is crucial. Get ready to discuss royalty rates, lease terms, and other provisions to secure the best deal for your situation.

Understand Your Lease Agreement:

Before signing any agreement, thoroughly understand the terms and conditions, including how royalties are calculated and when they will be paid.

Monitor Production and Reporting:

Keep an eye on production volumes and ensure accurate reporting. Mistakes or inaccuracies can result in underpayment of royalties.

Consult Experts:

If you’re unsure about any aspect of your lease or royalties, consult with legal and financial experts who specialize in mineral rights and oil and gas leases.

Plan for Taxes:

Royalty income is subject to taxation, so it’s essential to plan for tax liabilities and deductions.

Key Considerations for ORI Holders

If you hold overriding royalty interests in oil and gas production, here are some considerations:

Understand Your Interest:

Clearly understand the terms of your ORI, including the royalty rate, calculation method, and any potential deductions or expenses that may apply.

Monitor Production:

Keep track of the production volumes and ensure that you receive accurate and timely royalty payments.

Tax Implications:

Consult with tax professionals to understand the tax implications of your ORI income and to ensure proper tax planning.

Diversify Your Portfolio:

If you hold multiple ORIs, consider diversifying your investment portfolio to spread risk and potentially benefit from various production types.

Stay Informed:

Stay informed about industry trends, market prices, and regulatory changes that could impact your ORI income.

Understanding how to calculate oil and gas royalty payments is essential for both landowners and ORI holders. The calculation methods, factors affecting royalties, and key considerations outlined in this guide provide valuable insights into this intricate aspect of the energy industry.

Whether you’re a landowner negotiating a lease agreement or an investor managing ORIs, being well-informed and proactive in your approach is key to maximizing your royalty income and ensuring fair compensation for the use of your mineral rights. Additionally, seeking professional guidance from legal, financial, and tax experts is advisable to navigate the complexities of oil and gas royalty payments effectively.

If you have further questions related to the Oil and Gas Royalty topic, feel free to reach out to us here.

Leave a Reply

Want to join the discussion?Feel free to contribute!