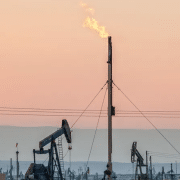

Effects of environmental regulations on oil and gas royalties

Environmental regulations play a crucial role in shaping the landscape of the oil and gas industry. It is influencing everything from exploration and production activities to royalty payments. Governments around the world implement stricter environmental standards. This is to address climate change and protect natural resources, oil and gas companies face increasing scrutiny and compliance requirements. In this comprehensive article, we explore the effects of environmental regulations on oil and gas royalties. We will examine how regulatory frameworks impact industry operations, financial performance, and stakeholder relationships.

Understanding Environmental Regulations in the Oil and Gas Industry

Environmental regulations governing the oil and gas sector encompass a wide range of issues, including air quality, water management, waste disposal, and greenhouse gas emissions. These regulations are implemented at the local, national, and international levels by government agencies such as the Environmental Protection Agency (EPA) in the United States and the European Union’s Directorate-General for Environment. Key environmental regulations affecting the oil and gas industry include:

- Clean Air Act (CAA): The CAA regulates air emissions from oil and gas operations, including criteria pollutants such as nitrogen oxides (NOx), sulfur dioxide (SO2), volatile organic compounds (VOCs), and hazardous air pollutants (HAPs). Compliance with CAA requirements may involve installing emissions control equipment, implementing leak detection and repair programs, and obtaining permits for air emissions.

- Clean Water Act (CWA): The CWA regulates discharges of pollutants into surface waters, including produced water, drilling muds, and other wastewater generated during oil and gas operations. Companies must obtain permits under the National Pollutant Discharge Elimination System (NPDES) to discharge wastewater into water bodies and implement best management practices to prevent water pollution.

- Resource Conservation and Recovery Act (RCRA): The RCRA governs the management and disposal of hazardous waste generated by oil and gas activities, including drilling fluids, hydraulic fracturing fluids, and contaminated soils. Compliance with RCRA requirements involves proper handling, treatment, storage, and disposal of hazardous waste to minimize environmental risks and protect human health.

- Endangered Species Act (ESA): The ESA protects endangered and threatened species and their habitats from activities that may harm or jeopardize their survival. Oil and gas companies must conduct endangered species assessments and obtain permits from regulatory agencies to operate in areas inhabited by protected species, such as migratory birds, marine mammals, and endangered plants.

Impact of Environmental Regulations on Oil and Gas Royalties

Environmental regulations have far-reaching implications for oil and gas royalties, affecting royalty calculations, production costs, and overall profitability. The following are some key effects of environmental regulations on oil and gas royalties:

Compliance Costs

Meeting environmental compliance requirements incurs significant costs for oil and gas companies. It includes investments in pollution control technologies, environmental monitoring programs, and regulatory compliance personnel. These additional expenses reduce companies’ net revenue from oil and gas production. It is impacting the amount of royalties paid to mineral rights owners and government entities.

Production Constraints

Environmental regulations may impose restrictions on oil and gas production activities. It includes emission limits, water quality standards, and habitat conservation measures. Compliance with these regulations can limit the scope and intensity of exploration and production operations. It leads to reduced output and lower royalty payments to mineral rights owners.

Permitting Delays

Obtaining permits for oil and gas activities under environmental regulations? It often involves a lengthy and complex regulatory review process, including environmental impact assessments, public hearings, and stakeholder consultations. Permitting delays can prolong the timeline for bringing oil and gas projects online. It will result ot delaying royalty payments to mineral rights owners and impacting project economics.

Legal and Regulatory Risks

Non-compliance with environmental regulations can expose oil and gas companies to legal liabilities. Moreover enforcement actions and regulatory penalties, including fines, injunctions, and permit revocations. Legal disputes and regulatory sanctions can disrupt production operations. It can also increase operating costs and erode profitability. It is affecting royalty payments to mineral rights owners and investors.

Reputational Impact

Environmental violations and controversies in the oil and gas industry can damage companies’ reputations erode public trust. It attracts negative media attention. Stakeholder perception of companies’ environmental performance can influence investment decisions. Moreover impacting shareholder value, and social license to operate, ultimately affecting royalty payments and corporate profitability.

Strategies for Managing Environmental Risks and Maximizing Royalties

Oil and gas companies can adopt various strategies to navigate the effects of environmental regulations on royalties and mitigate associated risks:

Environmental Compliance Planning

Developing comprehensive environmental compliance strategies and management plans can help companies proactively identify, assess, and mitigate environmental risks associated with oil and gas operations. Implementing robust environmental management systems, conducting regular audits, and investing in employee training and awareness programs can ensure compliance with regulatory requirements and minimize potential liabilities.

Technology Adoption

Embracing innovative technologies and best practices for environmental stewardship can enhance companies’ operational efficiency, reduce environmental impacts, and optimize production processes. Investing in advanced pollution control equipment, wastewater treatment technologies, and methane emission reduction measures can help companies meet regulatory standards while maximizing resource recovery and minimizing environmental footprint.

Stakeholder Engagement

Engaging with local communities, indigenous groups, environmental organizations, and regulatory agencies is essential for building constructive relationships, fostering transparency, and addressing stakeholder concerns. Collaborating with stakeholders throughout the project lifecycle, from planning and permitting to operation and closure, can help companies navigate regulatory challenges, secure social license to operate, and sustainably manage oil and gas royalties.

Risk Management and Insurance

Implementing comprehensive risk management strategies and obtaining appropriate insurance coverage? Well it can protect oil and gas companies against potential environmental liabilities, legal disputes, and financial losses. Purchasing environmental liability insurance, pollution legal liability insurance, and regulatory compliance insurance can provide financial protection. It can also give peace of mind for companies facing regulatory uncertainties and compliance risks.

Investment Diversification

Diversifying investment portfolios and revenue streams beyond traditional oil and gas assets? It can help companies mitigate the financial impacts of environmental regulations on royalties. Exploring opportunities in renewable energy, carbon capture and storage, and sustainable development projects can provide alternative sources. It focuses on revenue and reduce dependence on fossil fuel extraction. It will also contribute to environmental sustainability and social responsibility.

Environmental regulations have profound effects on oil and gas royalties, influencing production costs, compliance obligations, and stakeholder relationships. By understanding the impact of environmental regulations on royalty payments and adopting proactive strategies for managing environmental risks, oil and gas companies can navigate regulatory challenges, enhance operational resilience, and maximize returns for mineral rights owners, investors, and communities. With a holistic approach to environmental stewardship, regulatory compliance, and stakeholder engagement, oil and gas companies can sustainably manage royalties and contribute to the long-term viability and resilience of the industry amid evolving environmental pressures and regulatory expectations.

If you have any questions related to the Effects of environmental regulations, reach out to us here.

Leave a Reply

Want to join the discussion?Feel free to contribute!