Oil royalties are a pretty simple concept but can warrant some very significant income. Here is a century fact in the United States. Individuals have been receiving oil royalties for the valuable resources below their property. In this article, we are going to give a brief overview of what are oil royalties. Additionally, we will talk about some opportunities for oil royalties for sale.

Oil Royalties for Dummies: A Simple Overlook

An oil royalty is a payment receivable for the percentage ownership on the sale of produced oil. The royalty amount is agreed upon between the mineral rights landowner and the oil producer in a mineral rights lease.

Mineral Rights Leases: The Lessee vs. The Lessor

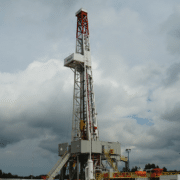

In a mineral rights lease, a landowner allows an oil company (as well as surveyors and engineers associated with the production) to explore their land for the purpose of extracting oil.

Here, the property owner is the lessor. The Lessor will still maintain the ownership of the property after the lease has expired. Similarly, the oil company is going to be the lessee. The lessee is entitled to the property’s subsurface for the duration of the lease, with access to the property’s surface defined in the contract.

How Can I Get Oil Royalties?

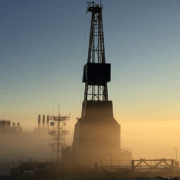

Once you found out what are oil royalties, the next question is to understand what is the most common way to get oil royalties. The answer is simple – it’s about leasing your mineral rights. Do you own property that may contain valuable resources below its surface? Then oil and gas companies may want to lease your land. In negotiating an oil and gas lease, you will likely receive an upfront bonus payment as well as monthly oil royalties from the sale of the minerals extracted from your land.

How Much are Oil and Gas Royalty Payments?

As you may imagine, there is a huge range between different oil and gas royalty payments around the country. For most oil and gas leases, the property owner receives between 10% to 25% of the sale of precious minerals extracted from the land.

As wells can produce highly variable amounts of oil and gas, royalty payments can range anywhere from a few hundred dollars to tens of thousands of dollars each month. Commonly, oil and gas royalty payments are split between multiple owners.

If you have further questions about oil royalties or have oil royalties for sale, we can assist you further here.