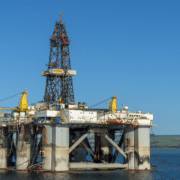

Colombia’s state-held oil firm Ecopetrol has a strategic alliance with Occidental Petroleum. It is to develop acreage in the Permian. There are plans to have drilled as many as 100 wells in the most prolific U.S. shale basin. It is by the end of 2021. Ecopetrol’s CEO Felipe Bayon told a conference on Monday. Continue reading about Colombia oil production below.

“By the end of next year, we should have over a hundred wells,” Bayon said at a virtual conference, as carried by Reuters.

Last year, Ecopetrol and Occidental Petroleum Corp agreed to set up a strategic joint venture to develop unconventional reservoirs in approximately 97,000 acres of the Permian Basin in West Texas.

This deal was part of Ecopetrol’s strategic priorities to develop more unconventional resources and have more operations outside Colombia, the company said in November 2019.

Between November last year and June this year, Ecopetrol drilled 22 wells. However, oil production has slowed because of the oil demand and price crash in the pandemic, according to Bayon.

Despite the current low oil prices, Ecopetrol expects to have 100 wells drilled in the Permian by the end of next year, said the company’s executive.

Click here to read the full article.

Source: Oil Price

If you have further questions about Colombia oil, feel free to reach out to us here.