DISCLAIMER: We are not financial advisors. The content on this website is for educational purposes only and merely cites our own personal opinions. In order to make the best financial decision that suits your own needs, you must conduct your own research and seek the advice of a licensed financial advisor if necessary. Know that all investments involve some form of risk and there is no guarantee that you will be successful in making, saving, or investing money; nor is there any guarantee that you won’t experience any loss when investing. Always remember to make smart decisions and do your own research!

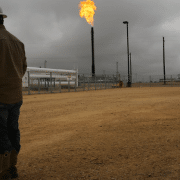

In the realm of passive income, investors constantly seek avenues that offer lucrative returns with minimal effort. Overriding royalty interests (ORIs) emerge as a promising option in this landscape, providing investors with a unique opportunity to generate passive income streams. This article delves into the role of overriding royalty interests, exploring their definition, benefits, and considerations for potential investors.

Understanding The Role of Overriding Royalty Interests

At its core, an overriding royalty interest represents a share of production revenue from a specific oil and gas lease. Unlike traditional royalty interests owned by mineral rights holders, ORIs are typically granted to third parties, such as landowners or investors, without ownership of the underlying mineral rights. Instead, ORI holders receive a percentage of the gross revenue generated from the production of oil, gas, or other minerals from the leased property.

The Benefits of Overriding Royalty Interests

One of the primary advantages of ORIs lies in their passive nature. Once acquired, ORIs require minimal ongoing effort or involvement from the investor. Unlike active business ventures or real estate management, ORIs offer a hands-off approach to generating income, making them an attractive option for individuals seeking to diversify their investment portfolios without significant time or resources.

Additionally, ORIs can serve as a hedge against inflation and market volatility. The value of mineral resources, particularly oil and gas, tends to rise over time, providing ORI holders with a potential for long-term appreciation. Furthermore, ORIs often come with contractual protections, such as minimum royalty payments or lease terms, offering investors a degree of stability and predictability in their income streams.

Considerations for Potential Investors

While ORIs present compelling opportunities for passive income generation, potential investors should approach them with caution and conduct thorough due diligence. Several factors warrant consideration before investing in overriding royalty interests:

Market Conditions: The profitability of ORIs is closely tied to the performance of the oil and gas market. Fluctuations in commodity prices, geopolitical factors, and technological advancements can impact the viability of ORIs as an investment vehicle. Investors should stay informed about market trends and assess the long-term outlook for the industry.

Legal and Regulatory Risks: Oil and gas operations are subject to a complex web of regulations at the local, state, and federal levels. Changes in legislation or environmental policies could affect the profitability of ORIs or impose additional compliance burdens on operators. Investors should seek legal counsel to ensure compliance with applicable laws and regulations.

Operator Reliability: The success of ORIs hinges on the competence and integrity of the operating companies responsible for extracting and selling the mineral resources. Investors should evaluate the track record and financial stability of potential operators before entering into agreements involving ORIs.

Diversification: As with any investment strategy, diversification is key to mitigating risk. While ORIs can offer attractive returns, investors should not allocate their entire portfolio to this asset class. Diversifying across different sectors and asset types can help safeguard against downturns in specific industries.

A Compelling Avenue

Overriding royalty interests represent a compelling avenue for passive income generation, offering investors a share of production revenue from oil, gas, or mineral leases. With their hands-off approach and potential for long-term appreciation, ORIs can serve as valuable additions to investment portfolios. However, prospective investors must conduct thorough due diligence and consider various factors, including market conditions, legal risks, operator reliability, and diversification strategies. By weighing these considerations carefully, investors can harness the benefits of overriding royalty interests while minimizing potential drawbacks.

If you have further questions related to the Role of Overriding Royalty topic, feel free to reach out to us here.