Financial modeling plays a pivotal role in assessing the feasibility and profitability of oil and gas investments. Whether you’re a seasoned investor or a newcomer to the industry, understanding the intricacies of financial modeling is essential for making informed decisions and maximizing returns. This comprehensive guide delves into the fundamentals of financial modeling for oil and gas investments, providing insights, techniques, and best practices to help you navigate this complex landscape.

Financial modeling for oil and gas investments involves analyzing various factors, including commodity prices, production costs, reserves estimation, and regulatory considerations. By constructing accurate and robust financial models, investors can evaluate the potential risks and rewards associated with different projects and optimize their investment portfolios accordingly.

Commodity Price Forecasting | Financial modeling

Commodity prices, particularly crude oil and natural gas, are critical drivers of revenue and profitability in the oil and gas industry. Effective financial modeling requires robust forecasting techniques to anticipate future price movements accurately. From historical data analysis to econometric modeling, investors employ a range of methods to forecast commodity prices and incorporate these projections into their financial models.

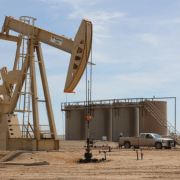

Production Cost Analysis

Analyzing production costs is another essential aspect of financial modeling for oil and gas investments. Production costs encompass expenses related to drilling, extraction, transportation, and operations, and can significantly impact project economics. Financial models should account for various cost drivers and factors such as technological advancements, labor expenses, and regulatory compliance to provide accurate cost estimates and assess project viability.

Reserves Estimation

Estimating reserves is a critical component of oil and gas financial modeling, as it directly influences project valuation and investment decision-making. Reserves estimation involves assessing the quantity and quality of recoverable hydrocarbons in a given reservoir, taking into account geological data, reservoir characteristics, and production history. Sophisticated reserve estimation techniques, such as probabilistic methods and decline curve analysis, help investors quantify reserves uncertainty and optimize investment strategies.

Risk Analysis and Sensitivity Modeling

Oil and gas investments are inherently exposed to various risks, including geological, operational, financial, and market risks. Financial modeling enables investors to conduct comprehensive risk analysis and assess the potential impact of risk factors on project economics. Sensitivity analysis, scenario modeling, and Monte Carlo simulation are powerful tools used to quantify risk exposures, evaluate risk-return trade-offs, and make informed investment decisions in volatile market environments.

Regulatory and Tax Considerations

Navigating regulatory and tax considerations is essential in oil and gas financial modeling, as regulatory frameworks and tax regimes vary significantly across jurisdictions. Financial models should incorporate relevant regulatory requirements, such as permitting processes, environmental regulations, and taxation policies, to accurately assess project economics and compliance obligations. Understanding the legal and regulatory landscape is critical for mitigating regulatory risks and optimizing tax efficiency in oil and gas investments.

Capital Structuring and Financing

Capital structuring and financing decisions play a crucial role in oil and gas investment projects, influencing funding sources, capital allocation, and project economics. Financial modeling helps investors evaluate different financing options, such as equity, debt, and project finance, and optimize capital structures to maximize returns and minimize financing costs. By assessing cash flow projections, debt service coverage ratios, and return metrics, investors can structure financing arrangements that align with their investment objectives and risk preferences.

Financial modeling is a powerful tool for evaluating the feasibility and profitability of oil and gas investments, enabling investors to assess risks, optimize returns, and make informed decisions in a dynamic and complex industry landscape. By incorporating accurate commodity price forecasts, production cost estimates, reserves assessments, risk analysis, and regulatory considerations into their models, investors can navigate uncertainties, capitalize on opportunities, and achieve success in oil and gas investing.

If you have further questions related to financial modeling, feel free to reach out to us here.